Insurance

Government rolls out Pilot Insurance-linked Securities Grant Scheme

In recent years the insurance sector has been actively opening up new markets and has requested the government on many occasions to provide full assistance. In response, the government has come up with policy concessions one after another, including granting a concessionary reduction in profits tax by half in respect of marine and specialist insurance items. In February this year, the Financial Secretary Paul Chan Mo-po further proposed a new favourable policy, the two-year Pilot Insurance-linked Securities Grant Scheme to attract insurance companies or organisations to offer insurance-linked securities in Hong Kong. The amount for each approved grant is capped at HK$12 million on the condition that the issuance size is at least HK$250 million and that Hong Kong service providers are engaged for the work.

Requesting reasonable grace period for introducing high protection investment-linked insurance

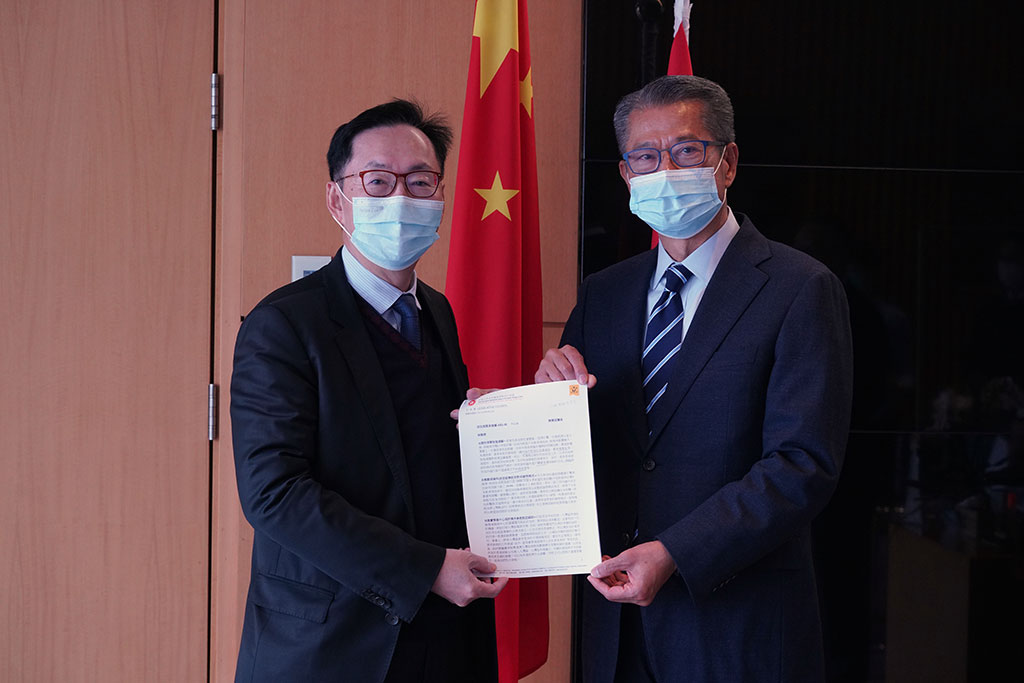

The Securities and Futures Commission (SFC) and Insurance Authority (IA) together with the insurance sector have been in discussions on issuing high protection investment-linked insurance to replace the investment-linked insurance currently available in the market. The insurance sector originally hoped that apart from issuing high protection investment-linked insurance, they would still be permitted to sell the investment-linked insurance that is currently available in the market and which has already been approved by the IA. The aim was to provide more choice to clients but this proposal was not accepted. In response, I have held many meetings in person or online with the SFC and IA to further discuss this issue. In the end, the industry was able to secure a grace period lasting 18 months.

Express opinions to the Financial Secretary regarding the Budget

Striving for prompt approval for cross-border sales of Hong Kong insurance products

The insurance sector has been hoping to enter the Greater Bay Area to set up insurance after-sales service centers. At present, the operation details are still under discussion between the Hong Kong and mainland authorities. However due to the current pandemic, discussions have been delayed. I have already taken this matter up with the Chief Executive and requested discussions be accelerated in order for the sector to launch it upon resumption of cross-border travel so as to aid the sector’s recovery. In addition, earlier in the year the government in reply to my queries on the Budget said that with the roll out of the cross-border Wealth Management Connectthe government would discuss the issue of cross-border sales of Hong Kong insurance products with the mainland after reviewing the relevant experience gathered. In view of this, I have already made representations to the Chief Executive requesting that such work start as soon as possible as cross-border sales of Hong Kong insurance products are vitally important to the insurance sector.

Exchange the views with LUAHK members

Pushing for completion of legislation for eMPF platform

The Legislative Council (Legco) approved legislation for the second stage of the eMPF platform in October 2020. The bill mainly defines the function of the eMPF Platform Company Limited as well as the supervisory role of the Mandatory Provident Fund Schemes Authority (MPFA) , etc. I was fully involved in the scrutiny of the bill and on behalf of the Hong Kong Trustees’ AssociationI submitted its views on the matter to the Bills Committee and followed up on issues raised by the association. In addition, with respect to the ceiling on administrative costs for the eMPF Platform, over the past several months, I held multiple meetings with MPF trustees and the Financial Services and Treasury Bureau to press for reasonable terms for the insurance sector.

Demanding review of legal aid system to crack down on insurance fraud

Earlier I commissioned the Legco Research Office to conduct a study on cracking down on insurance fraud. The subsequent report listed out the measures and experiences of foreign countries that are worth serious consideration. The report pointed out that the system for legal aid could indirectly encourage champerty. This is because currently applicants for legal aid could select lawyers from the Legal Aid Panel to act as their legal representative. I have already proposed to the government that it cancel the present arrangements for selecting legal aid lawyers and instead change to a system for arranging a lawyer based on the lawyer’s sequential listing in the Panel. All of the lawyers on the Panel are qualified so selection by way of sequential listing should not pose a problem. Moreover this arrangement can reduce the possibility of using legal aid for champerty.

Striving to remove barriers and reduce burdens for insurance sector

With the pandemic still ongoing around the world, doing business remains very difficult day by day. I have already requested the Chief Executive to review the current out-of-date compliant requirements and high levy fees to lessen the burden on the insurance sector so that it can have a chance to recover. In recent years, the compliant requirements have become ever more stringent. When the economy was buoyant, the insurance sector could still manage but in today’s weak economy, it is not easy for them as all sorts of problems have appeared. The government should adopt decisive measures to cancel some of the out-of-date requirements and adjust the various levy fees required of the insurance sector. By doing this, the insurance sector can continue to operate through times of difficulty.

Attend Insurance Forum 2021

Striving to develop technology for insurance

As digital platforms will be required for business in the Greater Bay Area in the future, the insurance sector therefore needs to speed up related development in order to meet future needs. At present although the Insurance Authority has been assisting in the development of insurance technology, the progress so far has not kept pace with actual requirements. I have already proposed to the government to increase resources to speed up development of such technology. In addition, I have also made a proposal to the government on providing assistance in the development of regulatory technology, including assisting the sector to achieve automation with regard to compliance, so as to reduce the high expense of compliance for the sector.